authorisation rates

Streamline network tokenisation

Most businesses with an online presence use payment tokenisation to help protect customers' sensitive card data during transactions. But managing tokens from different networks, issuers, and channels can be complex.

Our card brand–agnostic Token Management Service lets you simplify token management for your merchants with a single point of integration. Streamlining network tokenisation helps you create even more innovative, secure, and scalable solutions.

Increase conversions and revenue

The insights that come with network tokens make it easier to recognise legitimate repeat customers—helping enhance approval rates and increase conversions. What's more, network tokens could help merchants realise higher authorisation rates, which in turn can maximise revenue.

+8%

8% uplift in authorisation rates across Europe when compared to eCommerce PAN transactions.1

-28%

fraud

Network tokenisation can reduce fraud by an average of 28% without creating additional payment friction for customers.2

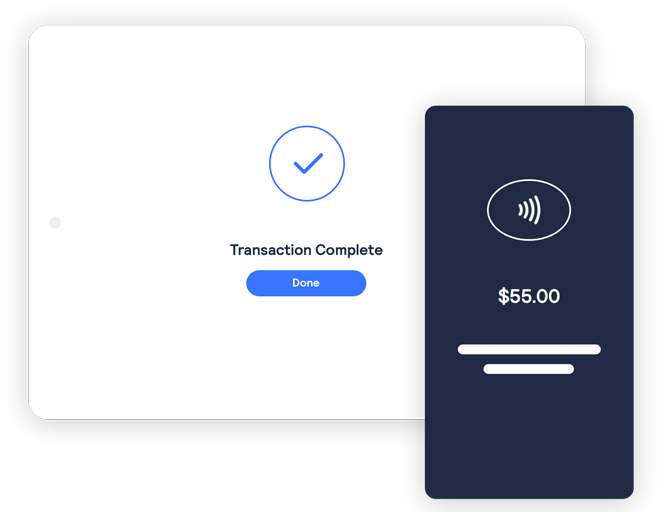

Create new payment experiences

Token Management Service collects data from traditional card brands (including Visa, Mastercard, American Express, and JCB) and alternative payment options to provide a complete view of each customer's buying behaviour across payment types.

With richer insights, merchants can build deeper relationships with their customers and create more personalised payment experiences across multiple channels.

Simplify customer lifecycle management

Credentials are automatically refreshed across channels to help maximise revenue from returning customers, keep recurring payments flowing, and reduce friction.

Protect sensitive data, support compliance

Tokenising sensitive cardholder information like addresses and phone numbers along with payment card data reduces risk, and Token Management Service adds further protection. Top-tier Visa security keeps sensitive data encrypted and secured, protecting it from breaches at every step of the payment process. And because payment data never touches your own or your merchants' internal systems, the scope of your PCI DSS compliance is reduced.

Our global tokenisation footprint3

7B+

tokens provisioned

500+

token requestors

189

live markets

8.5K

issuers enabled

>95%

issuer coverage (by payment volume)

Drive innovation and growth

Learn more about driving innovation and growth with Token Management Service on the Visa Acceptance Platform.

1 Source: Visa Analytics Platform 2023. Auth rate is defined as approved authorisations divided by total authorisation attempts based upon first attempt of a unique transaction.

2 Source: VisaNet Data, Global, YoY comparison between FY19 Q4 and FY20 Q4 share of token vs non-token PV for merchants with average 1k CNP token transactions per month. – Global Risk.

3 As of July 10, 2023

Ready to get started?

Let's build the future of great payment experiences together.