Welcome to our latest payment trends update, summarizing industry analysts' views on the transformative role of AI technologies and how AI in its many forms is impacting fraud.

While AI and GenAI can power services that help make shopping easier for consumers and businesses, the same technologies are also being exploited by cybercriminals to develop more sophisticated and large-scale fraud attacks. To help combat AI-driven fraud, the financial services and payments industries are increasingly integrating AI capabilities into their fraud prevention strategies.

Fight AI-driven fraud with AI-powered tools

The past few years have seen criminals wielding machine learning and automation to scale scams, while AI has helped fuel a relentless evolution in cyberattacks, says a recent report by Celent.1 The report notes that the recent emergence of GenAI helps fraudsters perform more sophisticated, larger-scale deceptions based on social engineering (manipulating people into divulging confidential or personal information that can be used for fraudulent purposes).

Celent estimates that AI was behind roughly 20% of the fraud perpetrated in 2024 across all sectors and anticipates it will fuel even more fraud moving forward. In response, says the report, financial institutions (FIs) need to fight fire with fire and leverage increasingly advanced models for AI fraud detection. It notes that:

- Efforts by banks, processors, and their technology partners to apply GenAI to fraud operations are gaining steam

- Fraud detection and prevention are at the top of the list of functions for which FIs are most actively exploring the use of GenAI

GenAI and synthetic identity fraud

A recent report from Datos Insights2 recognizes that GenAI is likely to significantly increase the challenge for FIs in dealing with a particular type of fraud—synthetic identity—as it enables the creation of more convincing fraudulent identities at scale. This capability, coupled with deepfake technologies that can bypass biometric verification systems, is concerning for 2025 and beyond.

According to the report, 40% of FIs say they have evidence of increased attack rates related to GenAI. Because the creation of synthetic identities occurs upstream from onboarding processes, direct detection can be difficult until fraudsters begin to cash out. What's more, AI-generated synthetic identities can establish patterns that mimic good customer behavior, increasing exposure through cross-selling while evading detection.

To address this evolving threat, Datos suggests FIs should be proactive and vigilant by upgrading their capabilities. The report2 indicates that:

- Most FIs (83%) plan to invest in new onboarding tools to help detect synthetic identity fraud

- 36% of FIs plan to enhance account management capabilities relating to synthetic detection

The greater focus on onboarding tools would confirm that the most effective way to address fraud relating to synthetic identities is to prevent them from opening accounts in the first place.

Enhancing confidence in agentic commerce transactions

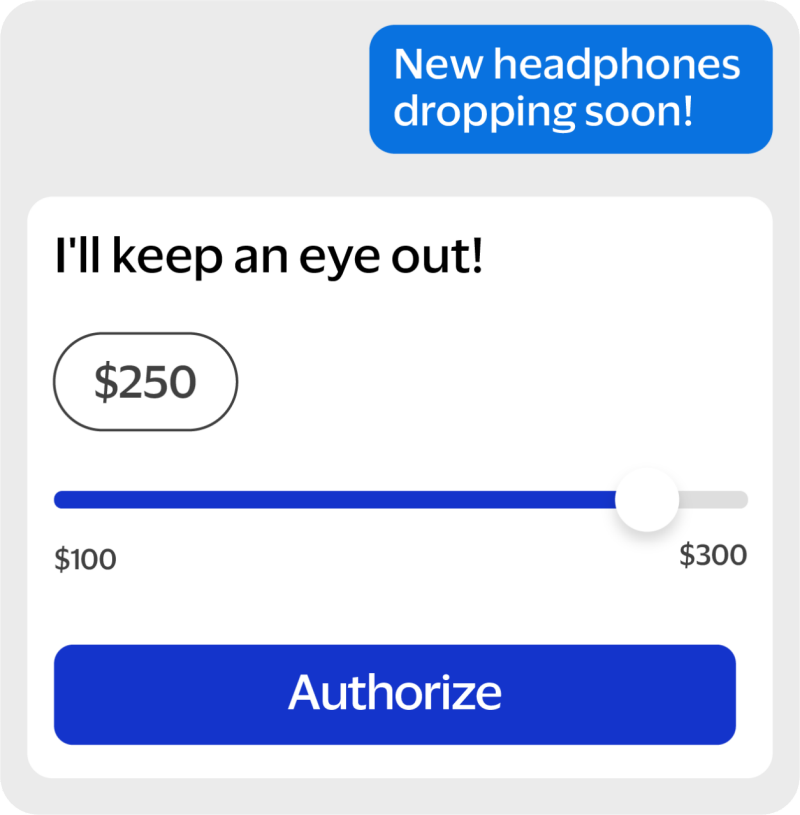

Agentic commerce (a form of agentic AI) is a new model for delegating identity and authority, in which shoppers grant conditional permissions to AI agents to act on their behalf in transactions. Javelin Strategy & Research3 notes that, from the perspective of technology and infrastructure, agentic commerce is similar to transactions made using saved cards or recurring payments, but with several new components:

- A new authorization layer covering the rules for governing how and when a transaction is carried out by an agent

- A new identity layer binding a known user or device to an agent

- A new risk approach shifting the liability for theft or abuse to new parties, like the agent provider or processor or platform

As agentic commerce grows, many of the assumptions built into traditional payment systems will change. For example, in a traditional card-not-present (CNP) transaction, a human initiates the transaction and is present in some way to confirm the purchase. Agentic commerce breaks that assumption by removing the person: "Transactions move beyond card-not-present to person-not-present."3

Authorizing an AI agent to shop and buy

Image source: Visa. “Intelligence Commerce.” https://corporate.visa.com/en/products/intelligent-commerce.html. Accessed June 25, 2025.

In this scenario, the agent authorized to initiate the payment becomes the front-line actor. And while the transaction may be valid, the initiating logic may not be human-readable, and the authorization may be indirect. Javelin describes this as a shift that will "test how well financial services infrastructure is prepared for delegated authority, dynamic authorization, and real-time enforcement of identity and policies."

A related Javelin report4 echoes this sentiment by pointing out the importance of trust among the parties in these types of transactions. Doing so involves:

- Comprehensive identity verification (IDV)

- Continuous authentication

- Real-time fraud and scam detection that analyzes a variety of transactional, device, and behavioral data from the consumer-to-agent and agent-to-merchant perspectives

Given the differences between human- and agent-derived data and behavioral analytics, the authenticity of a transaction originating from an agent must be scrutinized differently from one initiated by a consumer. Merchants will therefore need to know when a transaction is initiated by an agent so that they can follow any additional protocols.

How consumers view AI-driven fraud prevention

The same Javelin report4 discusses consumers' attitudes to FIs' use of AI to protect their accounts and identities. It reveals that most consumers are aware of AI's potential use in fraud, with 88% saying they are at least somewhat concerned that AI will be used to commit identity fraud.

Regarding consumers' attitudes to the use of AI-driven fraud prevention tools, the report finds that:

- 36% of consumers said they already trust their FI is using AI responsibly to detect and prevent identity fraud

- 49% of consumers said they were OK with their FI using AI, but wanted the FI to explain how AI works and how it was being used

- Only 15% said they didn't trust AI and would prefer their FI to use an alternative means of protection against identity fraud

These stats would indicate there's an opportunity for FIs to educate consumers about the convenience and security benefits of AI and to further build their trust in AI as a secure tool. After all, consumers who trust AI to help protect their identities and accounts and see how it simplifies their lives are more likely to use AI in their everyday banking and shopping activities.

We'd love to talk

This selection of analyst research and predicted trends show how AI in its many forms can help fuel fraud, boost fraud prevention, and add convenience to everyday payments. We'd love to discuss these and other trends in payments and eCommerce with you.

Feel free to reach out and discover how Visa Acceptance Solutions and our uniquely open payments platform can help you build the future of payments.

And keep an eye out for our next update for more news and commentary.

1 Celent: 'Migrating Fraud in the AI Age: Understanding the Challenge'; Neil Katkov, March 2025

2 Datos Insights: 'AI-Powered Synthetic Identity Attacks Pose a Novel Risk to Financial Institutions'; Jim Mortensen, March 2025

3 Javelin Strategy & Research: 'Here Come the AI Agents. The Proxy Economy: AI Agents and the Payment Stack'; James Wester, Matthew Gaughan, May 2025

4 Javelin Strategy & Research: 'Here Come the AI Agents. Fraud in the Age of Agentic Commerce'; Suzanne Sando, May 2025

Disclaimer: Case studies, comparisons, statistics, research, and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Acceptance Solutions neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.